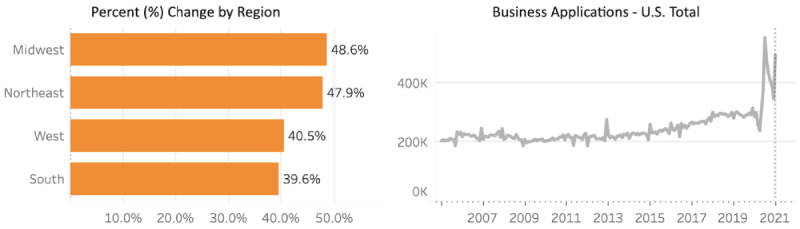

Recently, I saw some data on the US Census Bureau website that was both encouraging and troubling at the same time. I would imagine Charlotte business owners who might face tax problems would be interested in seeing this:

(Here is the page from which this is taken.)

What this tells me is that there was a massive spike in new business startups in 2020. I’m not sure what the data shows for Concord small businesses, but I imagine it is similar.

That’s very encouraging … more and more people are realizing that business ownership is potentially a smart path towards freedom.

Troubling … because with the recent rate of business failure that we’ve seen — well, let’s just say that I predict our tax problem resolution business will be getting much busier over the next few years.

Which is why it might make sense for people in Charlotte who have IRS debt issues or an unfiled tax return to grab some time with us NOW before things get much busier…

https://calendly.com/saragonzalez

But today’s Note is actually about filing taxes. As you know, it is tax time.

The unfortunate reality is that if you don’t file a tax return — even if you don’t owe any taxes that year — there can be problems. And, that is obviously the case if you do happen to owe taxes. Not only can the federal government stir up trouble for you, but each state has various consequences as well, and states sometimes have certain powers beyond those of the national government.

There is both good news and bad news that I want to share with my Charlotte readers about all of this…

Starting on the lighter side — if you don’t owe any taxes — here are some negative consequences of an unfiled tax returns …

You Don’t Receive a Tax Refund

If you are due a refund, but you don’t file, simply put, you will not get the refund. This applies to federal, as well as most states with an income tax. You have three years to file your federal return, but after that you lose the opportunity to claim your refund.

Business Owners: Lose Out On Carrying Over Losses

When you have business or investment losses, the IRS allows you to carry forward those losses to offset future years’ earnings. If you don’t file a return the year the loss occurs, you cannot carry losses forward from that year.

You Can Miss Refundable Tax Credits

If you qualify for a tax credit like the Earned Income Tax Credit (EITC), you have to file a return to claim it. This is a refundable credit (still under the new tax reform regime), and it puts money in your pocket. If you don’t file, you lose the tax credit.

The IRS Might File A Return On Your Behalf — Without You

In some cases, when you don’t file a tax return, the IRS automatically completes a substitute federal return (SFR) for you. This return contains information from W2s, 1099s, or other forms the IRS has received from your employer, your bank, or other entities. Typically, the SFR only has one exemption, no dependents, and the standard deduction.

If you qualify for more than one exemption, have dependents, or itemize instead of claiming the standard deduction, an IRS-prepared SFR will show a higher tax liability than it would if you filed yourself. In some cases, you might not have filed because you believed you owed no tax … but under the SFR that the IRS files on your behalf, you actually DO owe tax — and some of the worst consequences that I will be sharing below begin to kick in.

The Audit Time Clock Never Starts

When you file your tax return, the IRS has three years to audit it. After that point, the statute of limitations kicks in, and the agency cannot typically audit that return. However, if the IRS generates an SFR for you, it can be audited at any time. Again, if you file, you avoid the SFR. The IRS usually waits a few years after the due date to complete the SFR.

You May Not Qualify to Include Taxes in a Bankruptcy

To qualify for both Chapter 7 and Chapter 13 bankruptcy, you need to be current on your tax filing obligations. In most cases, you must have filed the last two years of returns for Chapter 7 and the last four years of returns for Chapter 13.

Trouble Getting Loans

If you don’t file a tax return, loans are much more difficult to obtain. Generally, when you apply for a mortgage, personal loan, business loan, or a loan for higher education, financial institutions will want to see copies of filed tax returns.

Here’s what can happen if you DO owe tax and don’t file your return …

1) Special Penalties

If you fail to file a Federal tax return by the due date, you face a special

“failure-to-file” penalty if you owe taxes. This equates to 5% of the balance for every month you don’t file. The “good” news is that this penalty maxes out at 25%. If you file at least 60 days late, your minimum penalty is the lesser of $205 or 100% of your tax owed.

2) Possible Incarceration

Jail time is rare but possible. Under federal law, you can face up to a year in jail and up to $25,000 in fines for not filing your return. The penalties are even stricter if you commit fraud. Fortunately, you cannot go to jail simply for owing taxes. Jail time is typically invoked for not filing or for purposefully evading taxes.

3) Publicly Posted Tax Liens

This is when the IRS files a public document called “Notice of a Public Tax Lien.” Consequently, the taxes you owe show up on your credit report. This negatively impacts your credit, as well as puts you in the crosshairs of all kinds of nefarious marketers.

4) Wage Garnishment

IRS wage garnishment takes place when the IRS contacts your employer to have wages withheld from your paycheck to satisfy an IRS tax debt.

5) Bank Levies

The IRS can contact financial institutions or banks you do business with to levy your bank account.

There are a few more things that can happen, but I’ll spare you the especially painful consequences.

Frankly, you are reading this, and it is time for the good news.

Short and sweet: You have KG Tax Resolution Services in your corner. There is NO SHAME IN OUR GAME. Which means that you can bring to us your pain, your mistakes, and this will be a “judgement free” zone.

And, even better, we can help you avoid ALL of these consequences with a little bit of our expert help in your corner.

Warmly,

Sara Gonzalez

https://calendly.com/saragonzalez

KG Tax Resolution Services