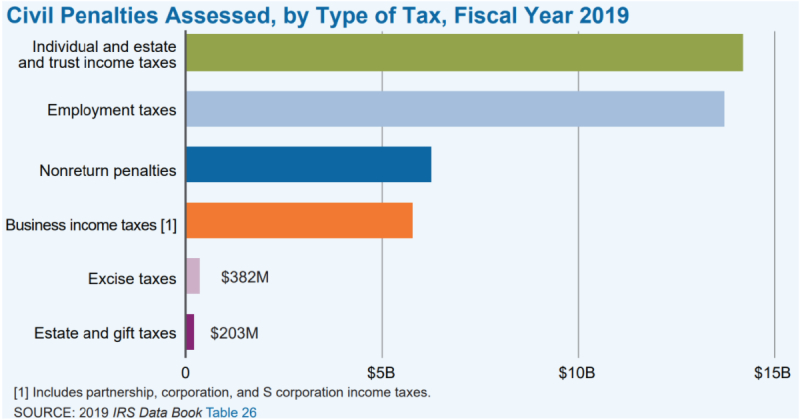

Every year, the IRS slaps tax debtors with a slew of penalties.

How much is it? If you live in Charlotte and owe taxes, you should absolutely look into it...

To put this in context, the IRS budget for 2021 is approximately $12 billion. That means that the IRS's whole function might be funded this year only from the penalties levied on people and small companies. This includes Concord residents who owe the IRS money.

When you're hit with these penalties, it can feel like the IRS is just rubbing salt in the wound. The last thing you want to see when you can't pay your taxes is...more taxes. Fortunately, the IRS offers a variety of penalty relief choices.

Abate for the First Time

If you or someone you know in Charlotte is qualified for penalty relief, the IRS offers a rather straightforward administrative procedure:

- Non-filing of a tax return

- Inability to deposit payroll taxes on time

- Payroll tax deposits are not made on schedule.

In order to be eligible for penalty abatement. Filing an extension request for your 2020 tax return is totally acceptable and counts toward eligibility for this program. Also, if the IRS has filed your tax return for you, this does not count. As a result, you'll need to file an actual tax return to replace the one produced by the IRS (which is fine because those are almost always wrong anyway and definitely not in your favor).

Furthermore, you must take the proper procedures to deal with the unpaid tax bill. To be eligible for penalty relief, you or other Charlotte filers in your circumstances must either pay off the tax amount or enter into a payment plan. If you are in a difficult situation and are unable to make monthly payments on your tax debt, the IRS might place you in a special non-collectible category. The disadvantage of this is that you are no longer eligible for penalty abatement.

This administrative waiver of penalties is something you or Charlotte taxpayers like you can get every few years. The IRS insists that you have a clean record with them for at least the three years prior to the year that you are requesting penalty relief for. For example, if you filed your 2019 tax return late and got penalized for it, the IRS will only waive those penalties if you were penalty-free in 2016, 2017, and 2018. So, while this program is called a “first time” abate, what it really means is “first time after three years.”

Due to this three year rule, when you owe taxes for multiple years, and thus have several years in a row of penalties, you’re only allowed penalty relief for the first year in the sequence. For example, if you owed taxes and filed late for 2016 through 2019, at best you’re only going to be eligible for penalty reduction on that 2016 tax debt.

Reasonable Cause Penalty Relief

The First Time Abate program is a fairly organized set of rules. You're either eligible...or you're not. However, the IRS understands that things aren’t always that straightforward for people all across the country including those in Concord.

If you have a reasonable excuse for why you didn’t file a tax return or pay your taxes on time, the IRS will consider it. Something for you or anyone you know in Charlotte that owes taxes to keep in mind. Still, they have specific rules for how they evaluate those kinds of requests, and decisions are made on a case-by-case basis.

Consider these questions to figure out if circumstances were “beyond your control”:

- Were you or a family member seriously ill?

- Did you experience the death of a loved one?

- Was there a natural disaster that affected your local area?

- Did you experience identity theft?

- Were there drug, alcohol, gambling, or other addiction issues?

If you or somebody in your immediate family (or anyone you know in Concord) experienced any of these types of issues, then you might be able to make a case for reasonable cause penalty abatement. If any of these were your situation, you and I will need to have a potentially difficult-for-you conversation, so I can try to connect the dots between your circumstance and your failure to file or pay taxes.

Offer in Compromise

Very few people ever qualify for this one, so I’m hesitant to even mention it. This is the proverbial “pennies on the dollar” settlement you may have heard rumors about. It does, in fact, exist, but there are very strict eligibility criteria for it. For example, in 2019 the IRS accepted less than 18,000 of these reduced settlements…nationwide.

Still, here’s why I mention it: If you’re eligible, all of the penalties and interest the IRS has charged you magically disappear. That’s right… ALL of them.

No explanation required. No excuses to be made.

If you are in such dire straits financially that you qualify for this program, then your entire tax debt is simply erased, penalties and all. That’s some potentially exciting news on the penalty relief front for Charlotte taxpayers who find themselves on the wrong side of the IRS.

Still, with all these rules and special requirements, this is clearly not something you should tackle yourself or anyone you know in the same situation in Charlotte. If you owe back taxes to the IRS, you undoubtedly have penalties, too. Let’s schedule a time to talk about your options:

https://calendly.com/saragonzalez

We’re in your corner…

Warmly,

Sara Gonzalez, CPA, CTC, CTRS

(844) 599-3355

KG Tax Resolution Services